Considering purchasing a home? Despite current mortgage rates appearing somewhat daunting, here are two compelling reasons why, if you're prepared and financially capable, taking the leap into homeownership could be a savvy decision:

- Home Values Generally Appreciate Over Time

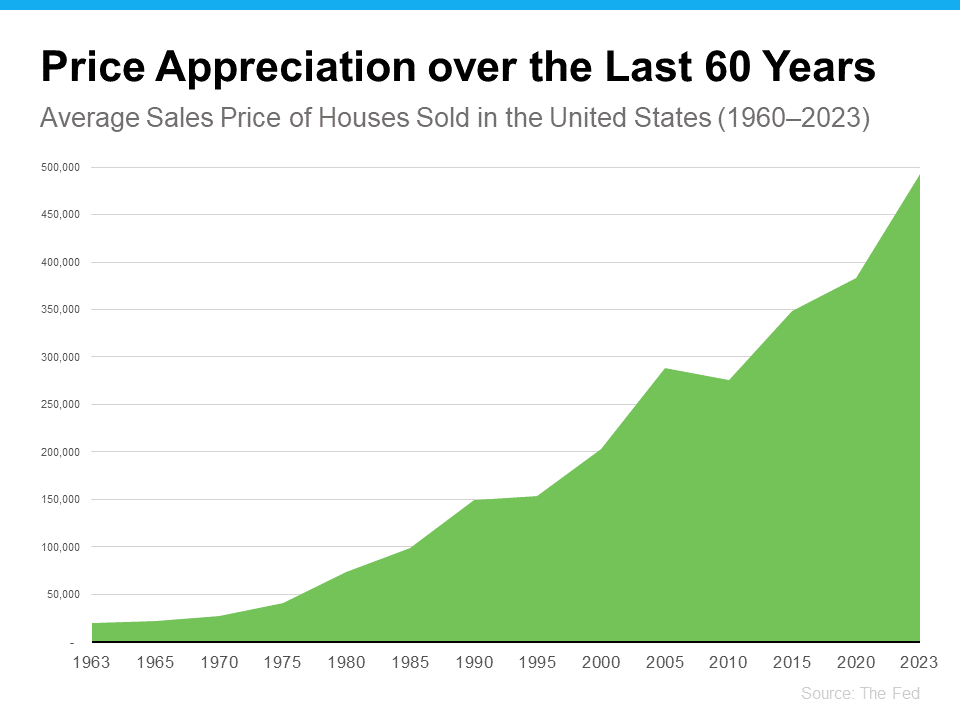

Amidst recent speculation about the direction of home prices, it's important to clarify that nationally, home values continue to rise. Over the long haul, home prices tend to appreciate consistently (refer to the graph below):

Utilizing data from the Federal Reserve (the Fed), a clear trend emerges: home prices have demonstrated a steady upward climb over the past six decades. While the 2008 housing crash presented a temporary deviation from this norm, home values have generally shown persistent growth.

This underscores a significant advantage of homeownership over renting. As home prices rise as you can see in the Rippe Group monthly market insights and you chip away at your mortgage, you're actively building equity. Over time, this burgeoning equity can substantially boost your overall net worth. The Urban Institute highlights:

“Homeownership is critical for wealth building and financial stability.”

2. Rents keep rising in the long run

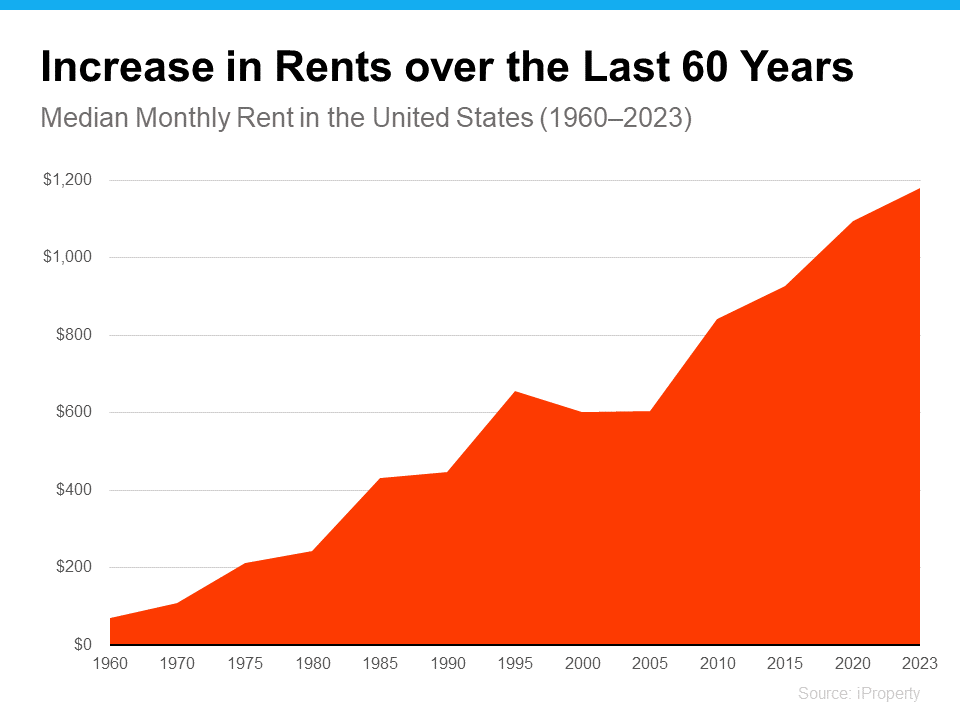

Additionally, consider the trajectory of rent over the long term. Rent prices continue to escalate year after year. Although renting may seem more affordable in certain locales presently, each lease renewal or new rental agreement often comes with higher costs. According to iProperty Management's data, rent has exhibited a consistent upward trend over the past six decades as well (refer to the graph below):

Looking to break free from the endless rent hikes? Say goodbye to unpredictable housing costs and hello to stability by buying your own home with a fixed-rate mortgage. It’s time to take control of your housing expenses—it’s a big deal!

Your housing payments are like an investment, and you've got a decision to make. Do you want to invest in yourself or keep paying your landlord?

When you own your home, you're investing in your own future. And even when renting is cheaper, that money you pay every month is gone for good.

As Dr. Jessica Lautz, Deputy Chief Economist and VP of Research at the National Association of Realtors (NAR), says:

“If a homebuyer is financially stable, able to manage monthly mortgage costs and can handle the associated household maintenance expenses, then it makes sense to purchase a home.”

Ready to stop renting and start owning? let’s talk to explore your options.

Ciao for Now!