As a premier global real estate advisory firm, Rippe Group is committed to providing you with the most current and insightful information to help you navigate the housing market with confidence. If you're considering a move this year, two critical factors are likely at the forefront of your mind: home prices and mortgage rates. The key question is whether it’s more advantageous to make a move now or to wait.

At Rippe Group, our sophisticated and data-driven approach ensures that we leverage the latest market insights to guide you through these important decisions. Here’s what the experts are forecasting for home prices and mortgage rates.

What’s Next for Home Prices?

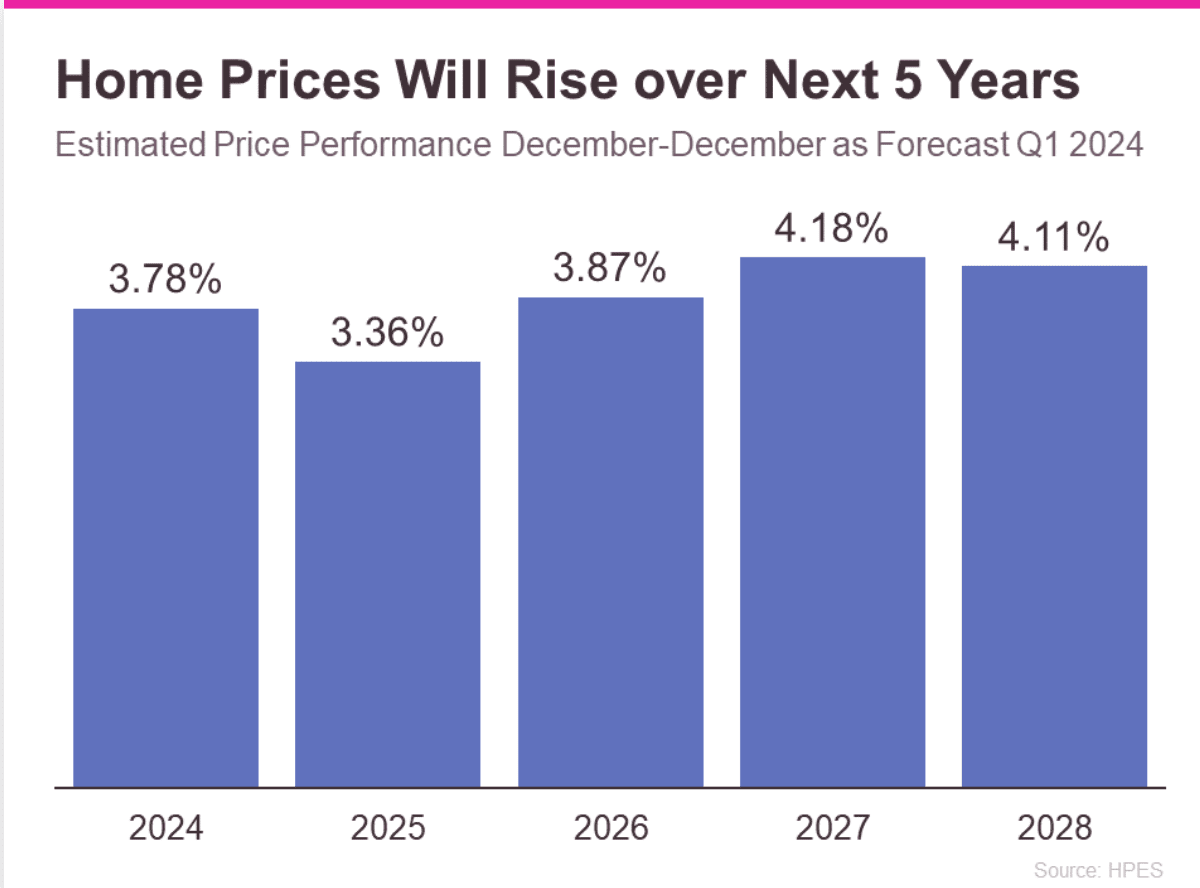

A trusted source for home price forecasts is the Home Price Expectations Survey by Fannie Mae. This survey collects insights from over a hundred economists, real estate professionals, and market strategists, making it a reliable indicator of future trends.

According to the latest survey, home prices are expected to continue rising at least through 2028:

While the rate of appreciation may vary from year to year, the consensus is clear: prices will rise, albeit at a more moderate pace compared to recent years. This means that if you decide to purchase a home now, it is likely to appreciate in value, allowing you to build equity over time. Conversely, waiting could result in higher home prices down the line, potentially making your future purchase more costly.

When Will Mortgage Rates Come Down?

The direction of mortgage rates is a complex issue, influenced by various economic factors. Odeta Kushi, Deputy Chief Economist at First American, explains:

“Every month brings a new set of inflation and labor data that can influence the direction of mortgage rates. Ongoing inflation deceleration, a slowing economy, and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

Currently, experts are cautiously optimistic that mortgage rates will decrease later this year. However, this outlook is contingent on fluctuating economic indicators. A CNET article notes:

“Though mortgage rates could still go down later in the year, housing market predictions change regularly in response to economic data, geopolitical events, and more.”

Making Your Move with Rippe Group

If you are ready, willing, and able to afford a home now, partnering with Rippe Group means you will have access to our extensive industry insights and international perspective. We will work closely with you to weigh your options and determine the best course of action based on the latest market data.

At our Ready to Take the Leap event we will provide you with the most up-to-date information on home prices and mortgage rate expectations. At Rippe Group, our approachable and personalized service will provide you with the knowledge you need to make an informed decision about your next move. Together, we will navigate these market dynamics to help you achieve your real estate goals.